》Click to View SMM Spot Aluminum Quotations

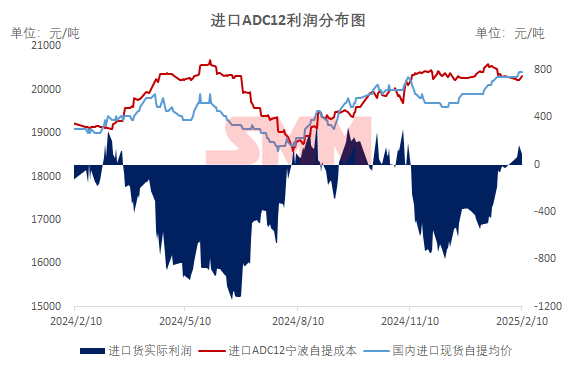

【Aluminum Prices Fluctuate and Pull Back, Secondary Aluminum Prices Remain Firm】Today, aluminum prices fluctuated at high levels. Spot SMM A00 aluminum prices fell by 60 yuan/mt from the previous trading day to 20,410 yuan/mt, while secondary aluminum prices remained firm. For domestic prices, SMM ADC12 prices were flat from the previous day at 21,100-21,300 yuan/mt. On the import side, overseas prices for imported ADC12 remained steady in the range of 2,420-2,450 USD/mt, with immediate profit for imported ADC12 maintaining a slight profit margin. This week, the secondary aluminum market continued its recovery phase, with market transactions gradually increasing, though upstream and downstream activities have not yet returned to normal levels. In the short term, ADC12 prices are expected to adjust narrowly in line with A00 prices.

Note: Import profit refers to real-time profit